In the case of a totaled car, the insurance check is typically paid to the policyholder or owner of the vehicle. In many cases, the lienholder, such as a bank or financing company, may also be listed on the check if there is an outstanding loan on the vehicle.

This ensures that both the owner and the lienholder receive the appropriate funds to cover the remaining balance of the loan. When a car is deemed a total loss, the insurance company will assess the value of the vehicle and provide compensation based on the policy coverage.

The process of handling insurance checks for totaled vehicles involves various parties, and understanding the distribution of funds is essential for both the owner and any lienholders. This article will discuss the key considerations and parties involved in receiving the insurance check for a totaled car.

Who Determines If A Car Is Totaled?

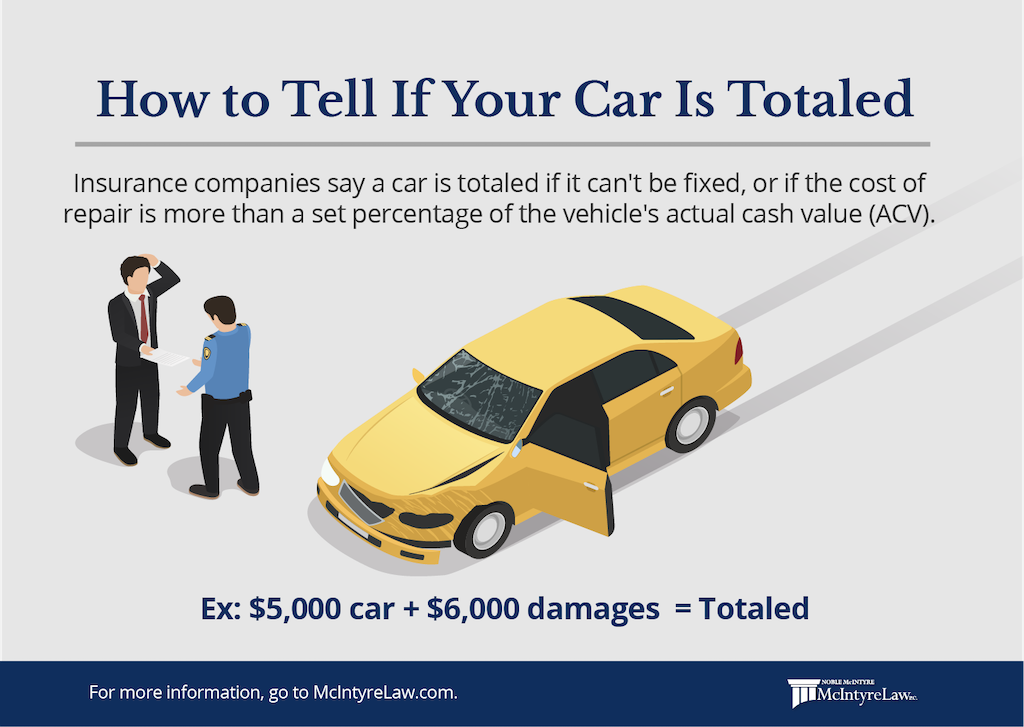

When a car is involved in a severe accident or sustains significant damage, the question arises: who determines if the car is considered totaled? This determination is crucial because it affects whether the owner will receive an insurance check for the car’s value.

Criteria Used To Determine Totaled Car

To determine whether a car is totaled, certain criteria are taken into consideration:

- An assessment is made based on the car’s pre-accident value.

- The cost of repairs needed to restore the car to its pre-accident condition is evaluated.

- If the cost of repairs exceeds a certain percentage of the car’s pre-accident value, typically 70% to 75%, the car is considered totaled.

It is important to note that the specific percentage may differ based on the insurance company’s policies and state regulations. However, the primary goal remains the same: determining if repairs are economically viable compared to the car’s value.

Role Of Insurance Company

The insurance company plays a decisive role in determining whether a car is totaled or not. The insurer’s expert assesses the damage and inspects the car to evaluate the cost of repairs. This evaluation is then compared to the car’s pre-accident value.

| Insurance Company’s Role | Responsibilities |

|---|---|

| Assessment | Evaluate the extent of damage and cost of repairs. |

| Comparison | Compare repair costs to the car’s pre-accident value. |

| Decision-Making | Determine if repairs are economical or the car is totaled. |

Role Of The Claims Adjuster

The claims adjuster serves as the primary representative of the insurance company and plays a crucial role in deciding whether a car is considered totaled.

The claims adjuster is responsible for:

- Reviewing the accident report and assessing the extent of damage.

- Inspecting the car and estimating the repair costs.

- Comparing the repair costs to the car’s pre-accident value.

- Providing recommendations to the insurance company regarding the car’s status.

- Ultimately, if repairs are deemed excessive, the claims adjuster will conclude that the car is totaled.

As the major decision-maker in the process, the claims adjuster’s evaluation and expertise heavily influence whether the car is considered totaled and the subsequent insurance payout provided to the car owner.

Understanding Total Loss Value

When a car is declared a total loss after an accident, the insurance check given to the owner is crucial in understanding the next steps. One of the key elements in determining the amount of this insurance check is the total loss value of the vehicle. Understanding how this value is calculated is important for all parties involved in the insurance claim process.

The Definition Of Total Loss

A total loss occurs when the cost to repair a damaged vehicle exceeds a certain percentage of its actual cash value. This percentage varies by state and insurance company and is often around 75% to 80% of the vehicle’s value.

When the cost of repairs surpasses this threshold, the car is deemed to be a total loss, and the insurance company typically pays the owner the vehicle’s actual cash value minus any deductible.

Factors Considered In Calculating Total Loss Value

- Age of the vehicle

- Mileage

- Condition before the accident

- Any aftermarket modifications or enhancements

- Local market prices for similar vehicles

This total loss value is determined by considering factors such as age, mileage, pre-accident condition, and any aftermarket modifications of the vehicle, as well as the local market prices for similar cars. Insurance companies may also use computer software and industry databases to assess the total loss value accurately.

Options With A Totaled Car

When a car is totaled in an accident, several options are available when it comes to dealing with the insurance check. Understanding these options can help you navigate the process and ensure you make the best decision for your situation.

Accepting The Insurance Offer

If you agree with the insurance company’s assessment of your car’s value, accepting their offer is a straightforward option. You can receive the insurance check and use it to purchase a new vehicle or cover other expenses related to the accident.

Negotiating The Settlement

If you believe the insurance company’s offer is too low, it’s possible to negotiate for a higher settlement. Providing evidence such as comparable car listings or repair estimates can support your case. Negotiating can help ensure you receive fair compensation for your totaled car.

Keeping The Vehicle

If you decide to keep the totaled car, the insurance company will deduct the salvage value from your settlement. This option allows you to potentially repair the vehicle and continue using it, but keep in mind that it may have a salvage title and could be more difficult to insure in the future.

Credit: barriosvirguez.com

Role Of Insurance Payout

When a car is deemed a total loss after an accident, the role of insurance payout becomes crucial. The insurance payout is the amount of money an insurance company reimburses the policyholder for the value of the vehicle that has been considered totaled.

This insurance payout serves multiple purposes, such as covering outstanding loans and replacing the vehicle. Let’s take a deeper look at each of these important aspects.

Purpose Of Insurance Payout

The purpose of an insurance payout is to provide financial compensation to the policyholder for the loss incurred due to the total loss of their vehicle. This payout helps the policyholder recover from the loss and get back on their feet without bearing the entire financial burden alone.

It not only covers the actual cash value of the vehicle but also assists in resolving any outstanding financial obligations tied to the vehicle.

Covering Outstanding Loans

Many car owners have outstanding loans on their vehicles at the time of an accident. These loans are typically taken to finance the purchase of the vehicle. When a car is deemed totaled, the insurance payout can be used to cover the remaining loan balance.

This ensures that the policyholder is not left with the responsibility of repaying a loan for a vehicle they no longer possess. By using the insurance payout to settle the outstanding loan, the policyholder can start fresh without any additional financial burdens.

Replacing The Vehicle

In addition to covering outstanding loans, the insurance payout often plays a critical role in enabling the policyholder to purchase a replacement vehicle. Losing a car due to a total loss can be a significant disruption to one’s daily life, especially if the car is essential for commuting or work.

With the insurance payout, the policyholder has the means to purchase a new vehicle and get back on the road as quickly as possible. It provides the necessary financial resources to replace the lost vehicle, helping the policyholder regain their mobility and independence.

Impact On Insurance Premiums

When a car is totaled in an accident, it can have a significant impact on your insurance premiums. The payout you receive from your insurance company plays a crucial role in determining your future rates.

Effect On Future Insurance Rates

The insurance payout you receive when your car is totaled can have a lasting effect on your future insurance rates. When you make a claim and receive a payout for a totaled car, it signals to the insurance company that you have had an accident, which can be seen as an increased risk factor.

Beyond the accident itself, the severity of the accident and the cost of the total loss affect your rates. If the accident was your fault and resulted in a costly total loss, it may lead to higher premiums in the future. On the other hand, if the accident was not your fault and you received a large payout, it may not impact your rates as much or at all.

Furthermore, insurance companies take into consideration your claims history. If you have multiple claims for totaled cars, it can have a cumulative effect on your insurance rates. The more claims you make, the higher the perceived risk you pose to the insurance company, and the more you may end up paying for your premiums.

Reporting The Total Loss

When your car is totaled, it is important to report the total loss to your insurance company promptly. Notifying them as soon as possible allows them to start the claims process and assess the extent of the damage. Delaying the reporting of the total loss can result in delays in receiving your insurance payout, which may hinder your ability to replace your car.

When reporting the total loss, provide your insurance company with all the necessary information, including a detailed account of the accident, photographs of the damage, and any relevant documentation, such as police reports. Providing accurate and thorough information will help expedite the claims process and ensure you receive a fair payout.

Additionally, it is important to keep in mind that reporting a total loss may result in your insurance rates being adjusted, as mentioned earlier. Therefore, it is crucial to consider the potential impact on your future premiums before deciding whether to report the total loss to your insurance company.

Credit: mcintyrelaw.com

Other Parties Involved

When a car is totaled in an accident, determining who receives the insurance check can be a complex process. While the ownership of the vehicle is a crucial factor, there are other parties involved that could impact the distribution of the funds. Let’s delve into the different scenarios that may arise when it comes to other parties involved in the insurance check distribution.

Liens On The Vehicle

If there are liens on the vehicle, the distribution of the insurance check becomes more complicated. A lien is a legal claim against the car, typically held by a financial institution when a loan is taken out to purchase the vehicle. In this scenario, the insurance check is first used to satisfy the outstanding loan balance.

If there is any remaining balance after the loan is paid off, it will be given to the vehicle owner. However, if the insurance check doesn’t cover the entire loan amount, the owner will still be responsible for paying the remaining balance to the lienholder. It’s important to note that lienholders have a legal right to the insurance proceeds, and the distribution of funds in this situation is primarily governed by the terms of the loan agreement.

Leased Or Financed Vehicles

For leased or financed vehicles, the insurance check is typically paid to the leasing company or the finance company that holds the loan. Since the leasing or financing company retains ownership of the vehicle, they have a vested interest in ensuring that their investment is protected.

In the case of a leased vehicle, the insurance payout may cover the outstanding lease balance, and any remaining funds may be returned to the lessee. However, if the insurance check exceeds the lease balance, the lessee may be entitled to receive the difference.

Similarly, for a financed vehicle, the insurance check will first go towards paying off the loan balance. Any surplus funds may be returned to the vehicle owner, or they can be used as a down payment for a new vehicle. It’s essential to review the terms of the lease or financing agreement to understand the specific details regarding the distribution of insurance proceeds.

Resolving Claims With Other Parties

When there are other parties involved in the insurance claim, such as third-party liability insurance or uninsured motorist claims, the distribution of the insurance check may also be affected. Third-party claims arise when the at-fault driver’s insurance is responsible for compensating the injured party.

If a settlement is reached, the insurance check will be issued to the injured party, based on their own insurance policy or the at-fault driver’s insurance coverage. The injured party may then use the funds to repair or replace the totaled vehicle.

In the case of an uninsured motorist claim, if the at-fault driver does not have insurance, the injured party’s own insurance policy may cover the damages. However, the distribution of the insurance check will depend on the specific policy and coverage limits.

Guidelines For Handling A Totaled Car

When a car is deemed totaled due to an accident, it can be quite overwhelming for the owner. Not only are they dealing with the emotional aftermath of the collision, but they also have to navigate through the process of reporting the incident to their insurance company and handling the insurance check. To help you understand your rights and responsibilities in such a situation, here are some guidelines to follow.

Know Your Rights And Responsibilities

Before you begin the process of handling a totaled car, it’s essential to understand your rights as the car owner and your responsibilities towards your insurance company. Knowing these rights and responsibilities can help you make informed decisions and avoid any potential pitfalls in the claims process.

- Understand the terms and conditions of your insurance policy, especially regarding total loss and the process for filing a claim.

- Know the laws and regulations in your state regarding totaled cars and insurance claims.

- Be aware of your responsibilities, such as promptly reporting the accident to your insurance company and cooperating with their investigation.

Document The Damages

When dealing with a totaled car, it’s crucial to document the damages thoroughly. This documentation will not only help in the claims process but also provide evidence to support your case if there are any disputes with the insurance company.

- Take clear photographs of the entire vehicle from different angles, highlighting the extent of the damage.

- Make a list of all damaged parts and components, along with their estimated repair costs.

- Obtain written estimates for the repairs from reputable auto repair shops to validate the cost of repairs.

Seek Legal Advice If Needed

In some cases, handling a totaled car can become complex, especially if there are disputes with the insurance company or if the accident involves other parties. If you find yourself in a challenging situation, it’s advisable to seek legal advice to protect your rights and ensure a fair resolution.

Remember: Consult an experienced attorney who specializes in personal injury or insurance claims to understand your legal options and the best course of action to take.

Frequently Asked Questions Of Who Gets The Insurance Check When A Car Is Totaled?

Who Gets The Check From The Insurance Company?

The insurance check is usually made out to the policyholder or the named beneficiary.

Can You Keep A Totaled Car In Texas?

Yes, you can keep a totaled car in Texas, but it must be declared non-repairable and have a salvage title.

What Is The Total Loss Threshold In Texas?

In Texas, the total loss threshold is the point at which the cost of repairing a vehicle exceeds a certain percentage of its fair market value, usually 100% or more. Once it reaches this threshold, the vehicle is considered a total loss by insurance companies and may be issued a salvage title.

Why Do Insurance Companies Total Cars With Little Damage?

Insurance companies may total cars with little damage to minimize repair costs and salvage value. They consider factors like the car’s market value, repair expenses, and safety risks. By totaling the car, they can provide a payout equal to its actual cash value.

Conclusion

Determining who receives the insurance check when a car is totaled can be a complex process. It generally depends on various factors, including the insurance coverage, the ownership of the vehicle, and any liens or loans on the car.

To ensure a smooth and fair claim process, it’s crucial to communicate with your insurance provider and seek legal advice if needed. Remember, understanding your policy and keeping records can help protect your rights in such situations.