Title pawning involves using your vehicle’s lien-free title as collateral for a loan. The lender places a lien on your title while you repay the pawn, but you retain possession of your vehicle.

This type of loan is short-term, and you provide your car as security in return for the loan amount. If you default on the loan, the lender has the right to repossess and sell your vehicle to recover the amount owed. It’s essential to fully understand the terms and conditions before entering into a title pawn agreement.

Introduction To Title Pawning

Title pawning, also known as car title loans, involves using a vehicle’s lien-free title as collateral for a short-term loan. The lender places a lien on the title while the borrower repays the loan, but the borrower retains possession of the vehicle.

This type of loan can provide quick access to cash, even for those with bad credit.

The Basics Of Title Pawning

Introduction to Title Pawning: Title pawning involves using your vehicle’s title as collateral for a short-term loan. If you are in need of quick cash and own a car outright, title pawning can be a convenient option.

How Title Pawning Fits Into The Financial Landscape

Title pawning is a type of secured loan that is often sought by individuals who may not qualify for traditional loans due to poor credit. By offering their vehicle’s title as security, borrowers can access funds quickly, making it a popular choice for those facing urgent financial needs.

Title Pawn Mechanics

Title Pawn Mechanics involve using your vehicle’s title as collateral for a loan. Once approved, you hand over the title temporarily while making payments. If you default, the lender may repossess and sell your vehicle to recover the loan amount.

The Process Of Securing A Title Pawn

In order to secure a title pawn, a borrower must provide the lender with the title to their vehicle as collateral. The lender will assess the value of the vehicle and offer a loan based on a percentage of that value. If the borrower agrees to the terms, they will hand over the title to the lender and receive the loan amount.

Evaluating Your Vehicle’s Worth

When evaluating a vehicle’s worth for a title pawn, the lender will consider factors such as the make, model, year, mileage, and overall condition of the vehicle. They may also use industry tools and resources to assess the market value of the vehicle to determine the loan amount they are willing to offer.

Financial Implications

Title pawning involves using your vehicle’s title as collateral for a loan, typically short-term. If you can’t repay the loan, the lender may repossess and sell your vehicle. It’s crucial to understand the financial implications before opting for title pawning.

Immediate Cash Access

When you opt for title pawning, you can gain immediate access to cash by using your vehicle’s title as collateral. The process is quick, and you can receive the funds on the same day you apply.

Interest Rates And Fees

Title pawning typically involves high interest rates and fees. Lenders may charge interest rates that are significantly higher than traditional loans. It’s crucial to understand the terms and conditions, including the total cost of the loan and any additional fees.

When considering title pawning, it’s important to be aware of the financial implications. While it provides quick access to cash, it’s essential to understand the interest rates, fees, and potential risks associated with this type of borrowing.

Legal Considerations

Title pawning involves using your vehicle’s title as collateral for a short-term loan. The lender places a lien on the title while you repay the loan, but you get to keep your vehicle. If you can’t repay the loan, the lender has the right to repossess and sell your vehicle.

State Regulations And Laws

When it comes to title pawning, it is important to understand the state regulations and laws that govern the process. Each state has its own set of laws regarding title pawns, so it is important to research and understand the laws in your state before considering a title pawn.

In Texas, for example, title pawning is legal, but there are certain regulations in place to protect consumers from predatory lending practices.

Repossession And Sale Of Vehicle

One of the biggest legal considerations when it comes to title pawning is the repossession and sale of your vehicle. If you default on your loan, the lender has the right to repossess your vehicle and sell it to recoup their losses.

In Texas, lenders can keep the full amount your vehicle sells for, even if it exceeds the amount you owed. It is important to understand the terms of your loan and make sure you can make the payments before considering a title pawn.

Overall, it is important to carefully consider the legal implications of title pawning before making a decision. Understanding state regulations and laws, as well as the repossession and sale of your vehicle, can help you make an informed decision about whether a title pawn is right for you.

Credit And Title Pawning

When it comes to borrowing money, your credit score plays a crucial role. However, if you have bad credit, traditional lenders may not be an option for you. This is where title pawning comes into play. Title pawning is a short-term loan that uses your vehicle as collateral. The lender holds onto your car title until you pay back the loan in full.

Impact On Credit Score

If you are considering title pawning, it is important to understand how it can impact your credit score. In most cases, title loans don’t affect your credit score because the lender doesn’t run a credit check. This means there will be no hard inquiry on your credit report. However, your on-time payments won’t help your credit either since the lender won’t report them to credit bureaus.

Title Pawning With Bad Credit

If you have bad credit, title pawning can be a good option since the lender uses the title to your car as collateral rather than your credit history. This makes it easier for individuals with bad credit to qualify for a loan. However, it is important to note that title pawning can come with high interest rates and fees, so it’s important to make sure you can afford the loan before taking it out.

In conclusion, title pawning can be a good option for individuals who need quick access to cash but have bad credit. However, it’s important to understand the potential impact on your credit score and to make sure you can afford the loan before taking it out.

Risks Of Title Pawning

Title pawning involves using your vehicle’s title as collateral for a loan, posing the risk of losing your car if you can’t repay the borrowed amount on time. Be cautious about high interest rates and potential repossession associated with title pawning.

Debt Cycle Potential

Title pawning carries the risk of trapping individuals in a perpetual cycle of debt. The high interest rates and fees associated with title pawning can make it challenging for borrowers to repay the loan. As a result, they may find themselves taking out additional loans to cover the existing ones, leading to a dangerous cycle of borrowing and indebtedness.

Losing Your Vehicle

One of the significant risks of title pawning is the potential loss of the borrower’s vehicle. When a borrower uses their vehicle as collateral for a title pawn, they are at risk of repossession if they fail to repay the loan according to the terms and conditions. This can result in the borrower losing their primary mode of transportation, creating significant disruptions to their daily life.

Benefits Of Title Pawning

When faced with financial emergencies, title pawning can provide a quick and accessible solution for obtaining cash. This alternative lending option allows individuals to use their vehicle’s title as collateral to secure a short-term loan, providing a range of benefits that make it a popular choice for many.

Why People Choose Title Pawning

Individuals opt for title pawning due to its simplicity and speed. With minimal documentation requirements and no credit checks, the process is straightforward and efficient, enabling borrowers to access funds swiftly in times of need.

Comparing To Other Loan Types

Unlike traditional bank loans or credit cards, title pawning does not rely on credit history, making it accessible to individuals with varying credit profiles. Additionally, the loan amount is determined by the value of the vehicle, allowing borrowers to secure funds based on the equity in their car.

Credit: www.bankrate.com

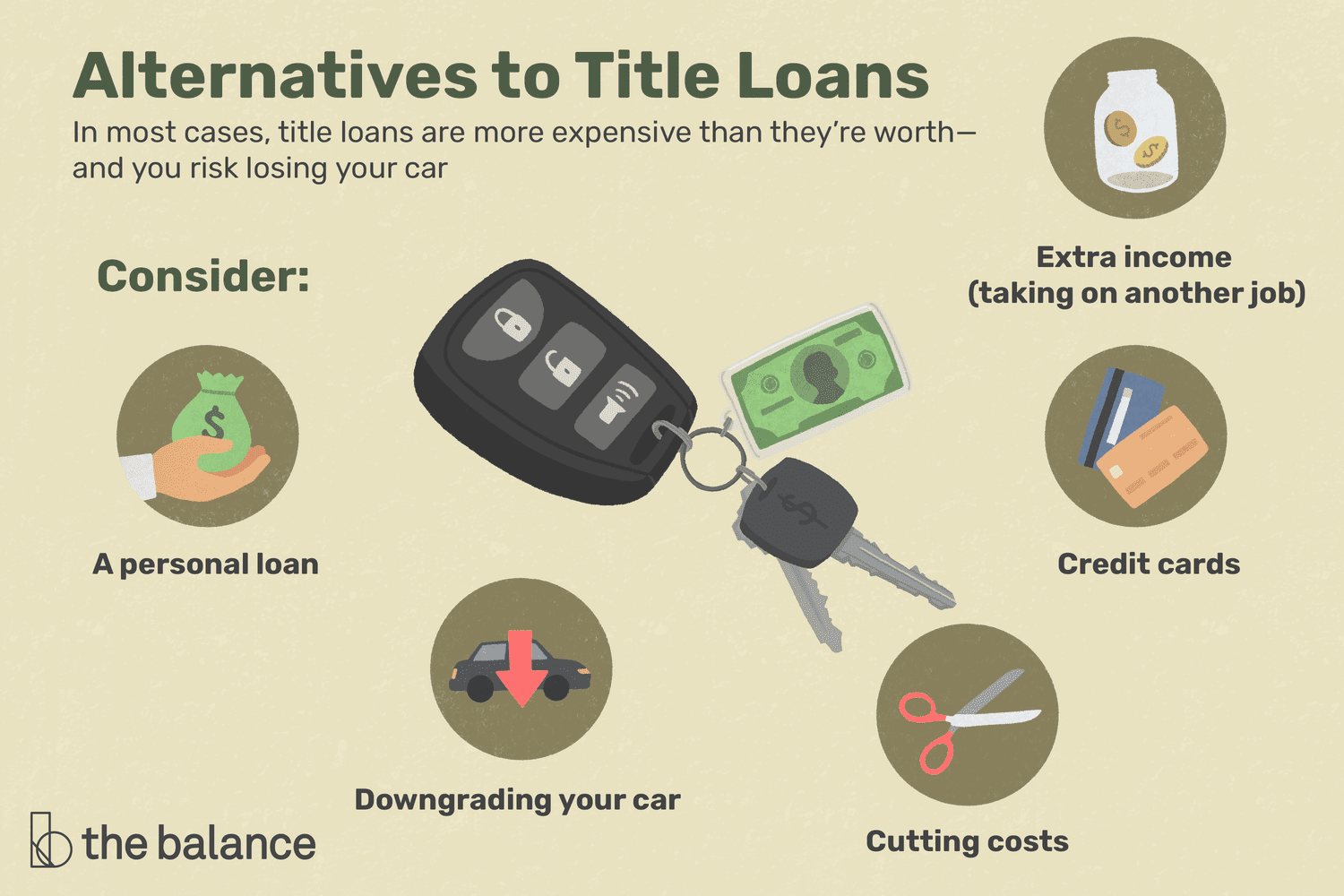

Alternatives To Title Pawning

Explore alternatives to title pawning by considering personal loans, borrowing from friends or family, negotiating with creditors, or seeking financial assistance programs. These options can help avoid the risks associated with title loans and offer more favorable terms for repayment.

Other Quick Cash Options

When considering alternatives to title pawning, there are several quick cash options available that can help you meet your financial needs without risking your vehicle.

- Personal loans from banks or credit unions

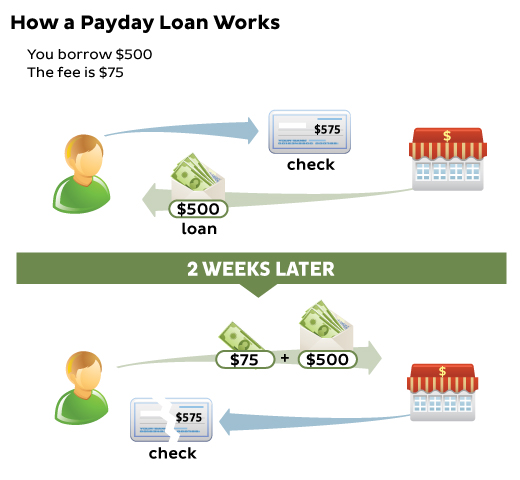

- Payday loans

- Online installment loans

- Credit card cash advances

- Pawn shop loans

Long-term Financial Solutions

For more sustainable financial stability, exploring long-term solutions can provide a solid foundation for your future financial well-being.

- Create a budget and stick to it

- Build an emergency fund for unexpected expenses

- Improve your credit score to qualify for better loan options

- Seek financial counseling or coaching for personalized guidance

- Consider debt consolidation or debt management programs

Making An Informed Decision

Understanding title pawning is crucial before making a decision. Assessing your financial situation and knowing when to consider a title pawn are key steps.

Assessing Personal Financial Situation

Before opting for a title pawn, evaluate your income, expenses, and ability to repay. Consider other options like personal loans or borrowing from friends and family.

When To Consider A Title Pawn

If you have a short-term financial need and own a vehicle with a clear title, a title pawn can provide quick cash. However, ensure you can repay on time to avoid losing your vehicle.

Frequently Asked Questions

What Are The Disadvantages Of A Title Pawn Lender?

Title pawn lenders often charge high interest rates, and failure to repay can lead to vehicle repossession. Limited regulation may expose borrowers to unfair practices and financial risks.

Does A Title Pawn Affect Your Credit?

Title pawns generally don’t impact your credit, as most lenders don’t perform credit checks or report payments to credit bureaus. However, failing to repay can result in vehicle repossession. In Texas, lenders can keep the full amount from the vehicle’s sale, even if it exceeds the owed amount.

Does Titlemax Go On Your Credit?

No, TitleMax typically doesn’t affect your credit. They use the title to your car as collateral instead of your credit history. If the lender doesn’t run a credit check, there will be no hard inquiry on your credit report. However, on-time payments won’t help your credit either since the lender won’t report them to credit bureaus.

What Happens If You Don’t Pay A Title Loan In Georgia?

If you fail to pay a title loan in Georgia, the lender has the right to repossess and sell your vehicle. In Georgia, the lender can keep the full amount your vehicle sells for, even if it exceeds the amount you owe.

It is important to make timely payments to avoid losing your vehicle.

What Is Title Pawning And How Does It Work?

Title pawning involves using your vehicle’s lien-free title as collateral for a loan. You retain possession of your vehicle while repaying the pawn.

Conclusion

Title pawning is a convenient way to access quick cash using your vehicle as collateral. However, it’s crucial to understand the terms and risks involved before opting for this financial solution. By staying informed and making wise decisions, you can effectively navigate the title pawning process and its potential impact.