A doc fee, also known as a documentation fee, is a fee charged by car dealerships to cover the cost of processing paperwork and completing sales. The amount of this fee can vary greatly from one dealership to another, and it may be capped by certain states.

However, in most cases, the doc fee is not negotiable. Car buyers need to understand this fee and consider it as part of the overall cost when purchasing a car. By being aware of the doc fee and understanding its purpose, buyers can make more informed decisions and negotiate the car’s price accordingly.

Purpose Of Doc Fee

A doc fee, or documentation fee, is a fee that dealers charge buyers to process paperwork and complete car sales. The amount of the fee can vary from dealership to dealership, and some states have capped the maximum amount that can be charged.

A documentation fee, also known as a dealer “doc fee,” is a fee charged by car dealerships when you purchase a vehicle. This fee is intended to cover the administrative and paperwork processing costs associated with the sale. While these fees are legitimate and common, it’s important to note that the amount charged can vary greatly from one dealership to another. Some states have regulations in place that cap the maximum amount that dealerships can charge as a doc fee.

Processing Paperwork

When you buy a car, there’s a lot of paperwork involved. From completing sales contracts and vehicle registration forms to processing title transfers and financing documentation, there are numerous administrative tasks required to finalize the purchase.

The doc fee helps cover the cost of these paperwork processing activities so that the dealership can streamline the buying process for their customers.

Varying Amounts Across Dealerships

It’s important to be aware that the amount charged as a doc fee can vary significantly from one dealership to another. There is no standard or fixed rate for this fee, which means that you might encounter variations in pricing when shopping for a car.

Some dealerships may charge a higher doc fee to increase their profit margins, while others may offer lower fees to attract more customers. It’s always a good idea to inquire about the doc fee when negotiating the price of a vehicle to ensure transparency and avoid any surprises.

Negotiating Doc Fee

A doc fee, or documentation fee, is a fee charged by car dealerships to process paperwork and complete sales. The amount of the fee can vary between dealerships, and some states have caps on how much can be charged. While negotiating the doc fee itself may be difficult, you can try negotiating the overall price of the car to offset the fee.

Strategies For Negotiation

When it comes to negotiating the doc fee when buying a car, there are a few strategies you can employ to try and offset or reduce this additional cost. While most dealerships are unlikely to negotiate the doc fee itself, there are other ways you can negotiate to ensure you don’t end up paying more than necessary.

Offsetting The Fee

One strategy you can use is to negotiate the price of the car more aggressively to offset the doc fee. If the fee is substantially higher than the median for your state, you can push for a lower price on the car to compensate for the additional cost. Keep in mind that dealerships also charge sales tax on the doc fee, so it’s important to factor that into your negotiations as well.

Another way to offset the fee is to negotiate other aspects of the deal, such as the trade-in value of your current vehicle or the financing terms. By getting a better deal in these areas, you can potentially lower the overall cost of the transaction, making the doc fee more manageable.

Ensuring Compliance With State Regulations

It’s also important to educate yourself about the maximum doc fee limit in your state. Some states have regulations in place to prevent dealerships from charging excessive fees. By knowing the maximum allowable amount, you can ensure that the dealership is not overcharging you.

| State | Maximum Doc Fee |

|---|---|

| Pennsylvania | $150 |

| Texas | $150 or |

| California | $90 |

| Florida | $799 |

Knowing these limits can give you leverage during negotiations and ensure you are not being charged more than what is legally allowed.

Conclusion

By employing effective negotiation strategies and understanding the regulations in your state, you can have a better chance of offsetting or reducing the doc fee when buying a car. Remember to be assertive and knowledgeable during the negotiation process to ensure you are getting the best deal possible.

Regulations And Limitations

When buying a car, it’s important to be aware of the various fees that dealerships may charge, including the documentation fee or “doc fee.” While these fees are legitimate and cover the costs of processing paperwork and completing the sale, it’s crucial to understand the regulations and limitations surrounding doc fees, as they can vary from state to state.

Maximum Doc Fee In Pa

In Pennsylvania, there is a maximum limit on doc fees. According to the Pennsylvania Association of Notaries, the current maximum doc fee is $389. This means that dealerships in Pennsylvania cannot charge more than $389 for processing paperwork and completing the sale of a car.

Doc Fee Limit In Texas

In Texas, there is also a limit on doc fees. According to the Texas Department of Motor Vehicles, the maximum doc fee that dealerships can charge in Texas is $150. This ensures that buyers in Texas are protected from excessive doc fees and gives them a clear understanding of the maximum amount they can be charged for documentation.

It’s important to note that these regulations and limitations may change, so it’s always a good idea to check with your local state regulations or consult with a professional when buying a car.

By understanding the regulations and limitations surrounding doc fees, you can make an informed decision and ensure that you are not being charged an excessive amount for documentation when purchasing a car.

Credit: www.doityourself.com

Transparency Of Doc Fee

A doc fee, also known as a documentation fee, is a charge imposed by car dealerships to cover the cost of processing paperwork and completing sales. The amount of this fee can vary significantly from one dealership to another, and some states have imposed maximum limits on doc fees.

When buying a car, it’s important to be aware of and understand any doc fees that may be included in the purchase.

Understanding The Breakdown Of Doc Fee

The dealership document fee, also known as the “doc fee,” is a charge that dealerships impose on car buyers to cover the administrative costs of completing the necessary paperwork and processing the sale.

While this fee is a legitimate part of the car buying process, consumers need to have a clear understanding of what it covers to ensure transparency in their purchase.

What It Covers

The doc fee typically includes a variety of administrative tasks that the dealership undertakes to finalize the sale. Some of the most common items covered by the fee include:

- Document processing: This includes the preparation and submission of all necessary paperwork, such as the title transfer, registration, and documentation required by state or local authorities.

- Legal compliance: Dealerships must adhere to various legal requirements, such as verifying identification, completing necessary disclosures, and ensuring all necessary paperwork is in order.

- Record-keeping: The dealership is responsible for maintaining accurate and up-to-date records related to the transaction, which may include sales contracts, warranties, and other documents.

- Administrative overhead: The dealership incurs costs in terms of personnel, technology, and facilities to manage the administrative aspects of the car buying process.

It’s important to note that the specific breakdown of the doc fee may vary from one dealership to another. However, dealerships are obligated to provide an itemized list of the fee components upon request, allowing buyers to understand exactly what they are paying for.

In conclusion, the transparency of the doc fee is crucial when buying a car. By understanding the breakdown of the fee and what it covers, buyers can make informed decisions and ensure they are getting the best value for their money.

Consumer Awareness

When buying a car, consumers must be aware of the additional costs associated with the purchase, such as the documentation fee, also known as the “doc fee.” These fees are often overlooked but can significantly impact the overall price of the vehicle.

Understanding the negotiability of the doc fee and its impact on the car purchase price is essential for informed decision-making.

Negotiability Of Doc Fee

Consumers need to recognize that the doc fee is often non-negotiable, as dealerships typically set this fee as part of their standard practice. However, in some cases, if the doc fee seems disproportionately high compared to the state’s average, buyers can attempt to negotiate a lower price for the car to offset the fee.

Additionally, being aware of the doc fee limitations set by the state can provide leverage for consumers during the negotiation process.

Impact On Car Purchase Price

The doc fee can have a significant impact on the overall purchase price of a car. As it is a fee for processing paperwork and completing the sales process, it adds to the total cost incurred by the buyer.

While the doc fee amount varies between dealerships, understanding its impact allows consumers to factor this additional cost into their budget and negotiation strategy, ensuring they make an informed decision when purchasing a vehicle.

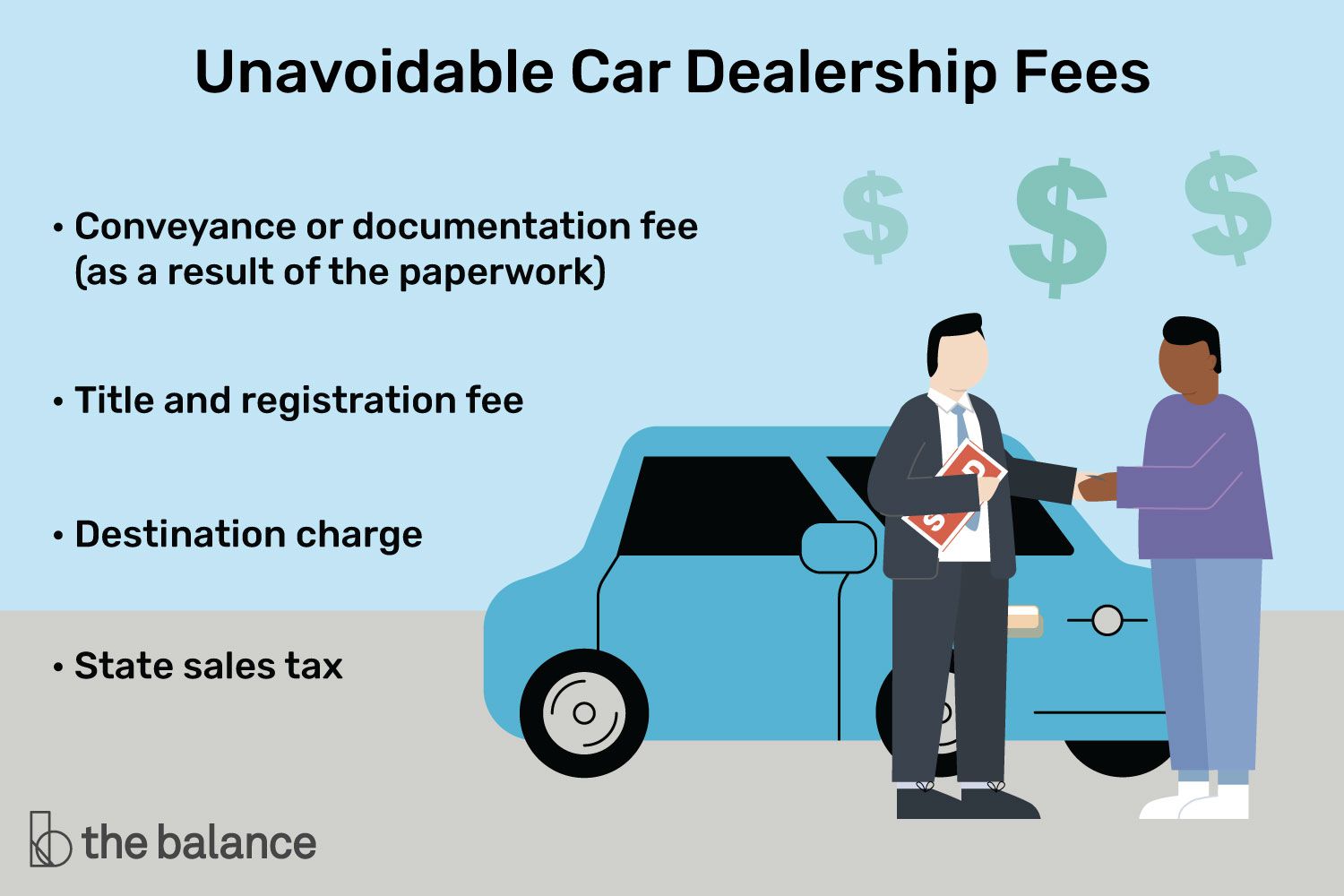

Dealer Fees To Watch Out For

When purchasing a car, it’s essential to be aware of various fees that dealers may impose. While some fees are legitimate and necessary for processing paperwork and completing sales, others could be exorbitant. Understanding these fees is crucial to making an informed purchase decision.

Documentation Fee

The documentation fee, also known as the dealer “doc fee,” is charged by dealers to cover the cost of processing paperwork related to the sale of the vehicle. This fee is legitimate, but the amount can vary significantly from one dealership to another.

It’s important to inquire about this fee and understand the maximum amount allowed by your state regulations.

Destination Charge

Another fee to watch out for is the destination charge. This fee represents the cost of delivering the vehicle from the manufacturer to the dealership. While this fee is standard, it’s essential to ensure that you are not being charged excessively for this service.

Legal Considerations

When purchasing a car, it’s important to consider the doc fee, which is the charge a dealership imposes to handle the paperwork and finalize the sale. The amount can vary between dealerships and is often not open to negotiation. It’s essential to be aware of the doc fee and include it when budgeting for a new car purchase.

Reasonableness Of Documentary Fee

One of the important legal considerations when it comes to doc fees when buying a car is the reasonableness of the fee. Each dealership may charge a different amount, and it is essential to ensure that the fee charged is reasonable and not excessive.

State laws may vary, and some states have caps on doc fees to protect consumers from being charged exorbitant amounts. It is crucial to familiarize yourself with the maximum allowable doc fee in your state, which can be found in the guidelines provided by your local authorities.

Actual Costs Incurred By The Seller

Another legal consideration when it comes to doc fees is whether they reflect the actual costs incurred by the seller in processing the necessary paperwork for the sale. It is important to understand that doc fees are meant to cover administrative tasks, such as processing titles, completing registration forms, and filing other necessary documents.

The dealership should be able to justify the doc fee by providing a breakdown of the costs associated with the administrative work. If you feel that the fee is unreasonable or inflated, it is within your right to negotiate or question the dealership regarding the actual costs incurred.

Transparency And Disclosure

Transparency and full disclosure are key components of any legal transaction, including car purchases. When it comes to doc fees, the dealership should clearly state the amount upfront, whether it is a fixed fee or a percentage of the sale price or vehicle value.

Ensure that the documentation fee is properly documented in the sales contract or agreement, including a clear explanation of what services or paperwork it covers. By having all the details in writing, you can protect yourself from any hidden fees or surprises later on.

Legal Remedies

If you believe that you have been charged an unreasonable or excessive doc fee that violates state laws or regulations, you may have legal remedies available to you. Consult with a legal professional who specializes in consumer protection or contract law to understand your options.

Keep in mind that resolving disputes can be time-consuming and may involve legal fees, so it is always advisable to perform due diligence and research the doc fee regulations in your state before finalizing a car purchase.

Frequently Asked Questions On What Is A Doc Fee When Buying A Car

What Is The Purpose Of A Doc Fee?

The purpose of a doc fee is to cover the dealership’s paperwork processing and sales completion. It varies from one dealership to another and may be capped in some states. While it’s not usually negotiable, you can offset it by negotiating the car’s price.

How To Negotiate Doc Fees?

To negotiate doc fees, focus on negotiating the car’s price. If the doc fee is higher than average, request a lower price on the car to offset the fee. Keep in mind that dealers also charge sales tax on the doc fee.

What Is The Maximum Doc Fee In PA?

The maximum doc fee in PA varies from one dealership to another. Some states have caps on doc fees, but it is not specified for PA. It is advisable to research and negotiate with the dealership to ensure you are not overcharged.

What Is The Doc Fee Limit In Texas?

The doc fee limit in Texas is $150. This fee is charged by car dealerships to cover the cost of processing paperwork and completing sales. It is important to note that the amount can vary from one dealership to another.

What Is A Doc Fee When Buying A Car?

A doc fee is a charge for processing paperwork and sales.

Conclusion

When buying a car, it’s important to understand what a doc fee is and why it’s charged by dealerships. A doc fee, also known as a documentation fee, is used to cover the cost of paperwork and administrative tasks associated with the sales process.

While these fees are legitimate, it’s worth noting that they can vary significantly from one dealership to another. Some states have capped doc fees, limiting the maximum amount that can be charged. It’s crucial to be aware of this fee and factor it into your negotiations and budgeting when purchasing a car.